Loans

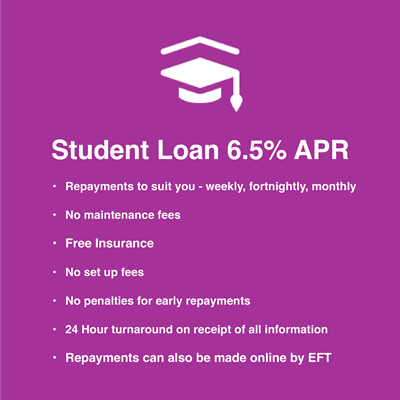

Are you waiting on your Leaving Cert results ?

Get ready for college with a Swilly Mulroy Credit Union Student Loan.

Try out our quick and easy loan calculator below

This calculator is for illustrative purposes only, to give you, the borrower, an overview of the potential cost of borrowing. The Credit Union, or any of its staff, cannot be held responsible for any errors. Please note that this calculator only provides an indicative quote and actual repayments may vary.

Don't Delay, Apply Today!

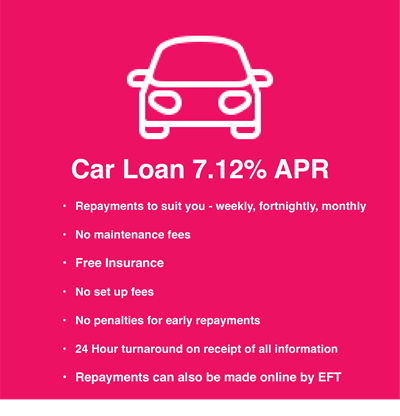

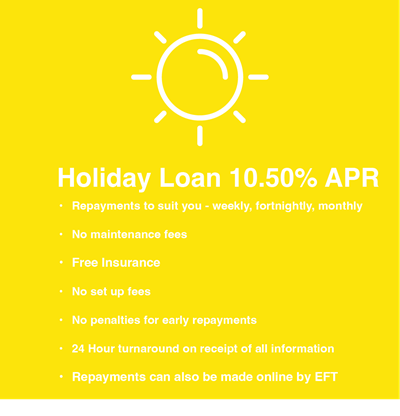

Time for a Holiday or buying a new car?

The Loan application process is an easy one and we will be there every step of the way. Swilly Mulroy Credit Union will consider loan applications from members for any purpose, each application is treated in the utmost confidence and will be considered on its own merit. It is Swilly Mulroy Credit Union’s policy to meet the borrowing requirements of as many members as possible, depending on the available funds.

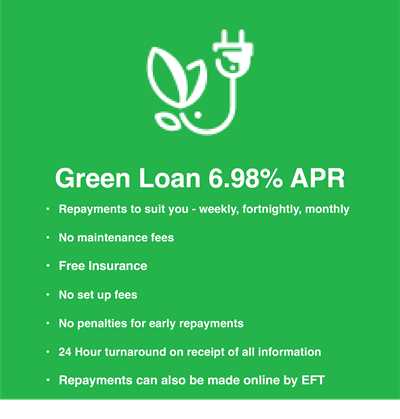

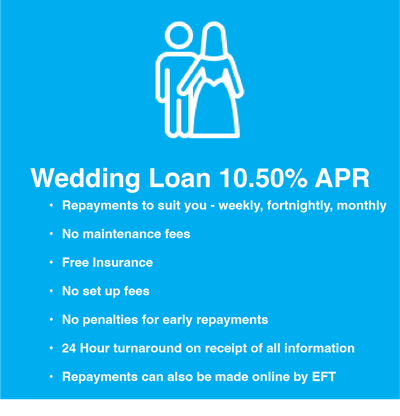

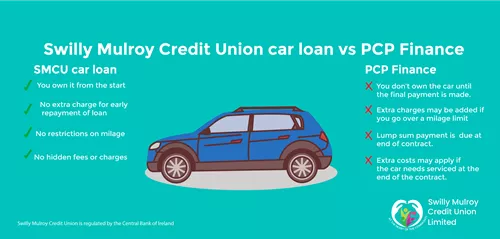

Swilly Mulroy Credit Union are here to help with whatever you have in mind. Providing loans is one of the main functions of a Credit Union and we provide loans on very reasonable terms to our members- remember we are here for you the people, not for profit.

Our loans at a glance